Here’s this week at a glance!

Actionable Strategy: How to Price Your Services

Framework: The Van Westendrop Model

Tool: Survey Monkey

GrowthHive Update: 128% Increase in Subscribers

Forwarded this page? Sign up for GrowthHive now.

💡Actionable Strategy: How to Price Your Services.

Determining the right price for your product or service is crucial for the success of your business.

If you’re price is off you might suffer from:

- Lost Revenue

- Profitability Issues

- Competitive Disadvantage

- Poor Brand Perception

- Inefficient Resource Allocation

It’s not just about covering your costs.

It’s about maximizing your revenue and staying competitive.

But, fear not!

After you’ve read this issue of GrowthHive, you should be able to price your product or services perfectly.

Or, at least almost perfectly (more on that later).

Ready to dive in? Me too!

What Businesses Typically Get Wrong About Pricing

How do businesses typically price their products or services?

- They base their pricing off their competitors.

- They talk to 2-3 customers about their pricing, and then base pricing off their competitors.

(If this sounds like you, keep reading).

Basing your pricing off your competitors.

This approaches overlooks the most important factor: the perceived value of your offering to your customers.

Pricing should be based on a deep understanding of your target market and what they are willing to pay for the value you provide.

If you have a unique product or service, you should have unique pricing!

Talking to customers about your pricing model.

Most people who talk to their customers get it wrong.

They’ll typically ask “How much would you pay for (insert product/service).”

You’re almost 100% of the time going to get a lowball answer.

Let me show you a better way.

The Van Westendrop Model: Determining the Perfect Price Point

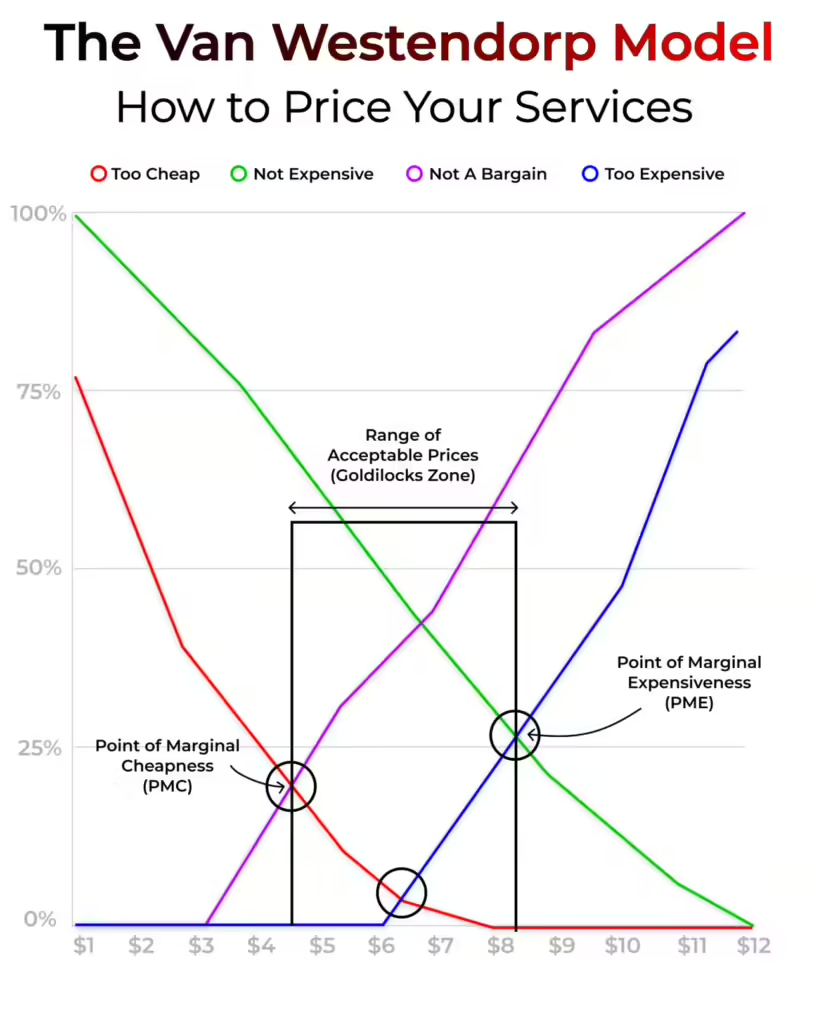

The Van Westendrop Pricing model offers a structured approach to pricing that takes into account customer perceptions and market dynamics.

Here’s how you can use it to determine the optimal price point for your product or service.

Step 1: Customer Survey

Start by conducting a survey among your target customers to understand their willingness to pay for your offering.

Here are the questions you’ll be asking:

- At what price would it be so low that you’d start to question the quality?

- At what price do you think this product/service is starting to be a bargain?

- At what price does this product begin to seem expensive?

- At what price is this product too expensive?

That’s it!

Step 2: Visualize the Results

Once you have gathered the survey data, create a Van Westendrop Price Sensitivity Meter (see below for framework).

This graphical representation will help you visualize the distribution of customer responses and identify the range of prices that are perceived as too cheap, too expensive, and just right.

What we’re looking for is the goldilocks zone (just right).

As prices go up, the number of people who think the product/service is too cheap or not expensive decreases.

As price increases the number of people who think the price is too expensive or not a bargain increases.

Step 3: Uncover Your OPP (Optimal Price Point)

The Point of Marginal Cheapness (PMC), where perceptions of a product being “too cheap” intersect with it not being seen as a bargain, establishes a lower boundary for acceptable prices.

Conversely, the Point of Marginal Expensiveness (PME), where perceptions of it being “too expensive” meet with it not being considered “not expensive”, sets an upper limit for potential prices.

Now, you’ve figured out the range of acceptable prices.

But, we have to take things one step further.

Limitations & Workarounds for the Van Westendrop Model

Now, there are a few limitations of the Van Westendrop model you should be aware of.

- The surveyed individuals may not have a sense of what the product is worth.

- The model only gauges consumer sentiment (without taking into account your fixed or variable costs).

- The model does not take into account competitors pricing (although, this could be implied by the answers give).

How do we work around the limitations?

Validation testing.

Step 4: Validation Testing

Once you have identified your Optimal Price Point (OPP), it’s important to validate it through testing.

Try these:

- A/B testing different price points with a segment of your customer base.

- Conduct pricing experiments to see how changes in price impact sales and revenue.

This can be done with existing customers OR with the next 10-20 or 30 customers.

For all you data nerds out there, you can then use these metrics to measure price sensitivity.

Price Sensitivity can be calculated using the formula:

Price Sensitivity = (Percentage Change in Quantity) / (Percentage Change in Price)

Alternatively, you can issue a post sale questionnaire regarding price satisfaction to gather qualitative insights from customers.

These questions will be the same as before, but you’ll be issuing them AFTER they’ve made the purchase.

- At what price would it be so low that you’d start to question the quality?

- At what price do you think this product/service is starting to be a bargain?

- At what price does this product begin to seem expensive?

- At what price is this product too expensive?

From there, you can plot them on the Van Westendrop Model.

Pro Tip: This only works if you keep all variables the same except price.

🧠 Framework: The Van Westendrop Model

This weeks framework is The Van Westendrop Model.

The Van Westendrop Model is my method of choice when trying to figure out the amount a consumer is willing to pay for my products or services.

When used correctly (as stated above), you can differentiate your pricing model from your competitors and enhance your go-to-market strategy.

🛠️ Tool: SurveySparrow

SurveySparrow is my go-to tool for customer feedback surveys because it integrates seamlessly with most of the tools I’m already using (HubSpot, Zapier, Notion, etc.)

Its user-friendly interface and robust features allow me to design surveys that capture valuable pricing insights from my customers.

🍯 GrowthHive Update: Almost 1,000!

Here’s the inside scoop on GrowthHive!

Number of Subscribers: 855

Weekly Growth Rate: 480

Open/Click Through Rate: 50.4% / 5.4%

Revenue Since Launch: $0

Notes: This week was awesome!

GrowthHive picked up 480 organic subscribers (all from LinkedIn).

As a reminder, I’m planning on monetizing when we hit 25,000 subscribers (I’m hoping about 3 months or so).

From now until then, the biggest changes will be the number of subscribers and open/click rates!